Tips for Improving Your Credit Score Using Credit Repair Software | Client Dispute Manager Software

Posted March 25, 2023 by SpotCodes

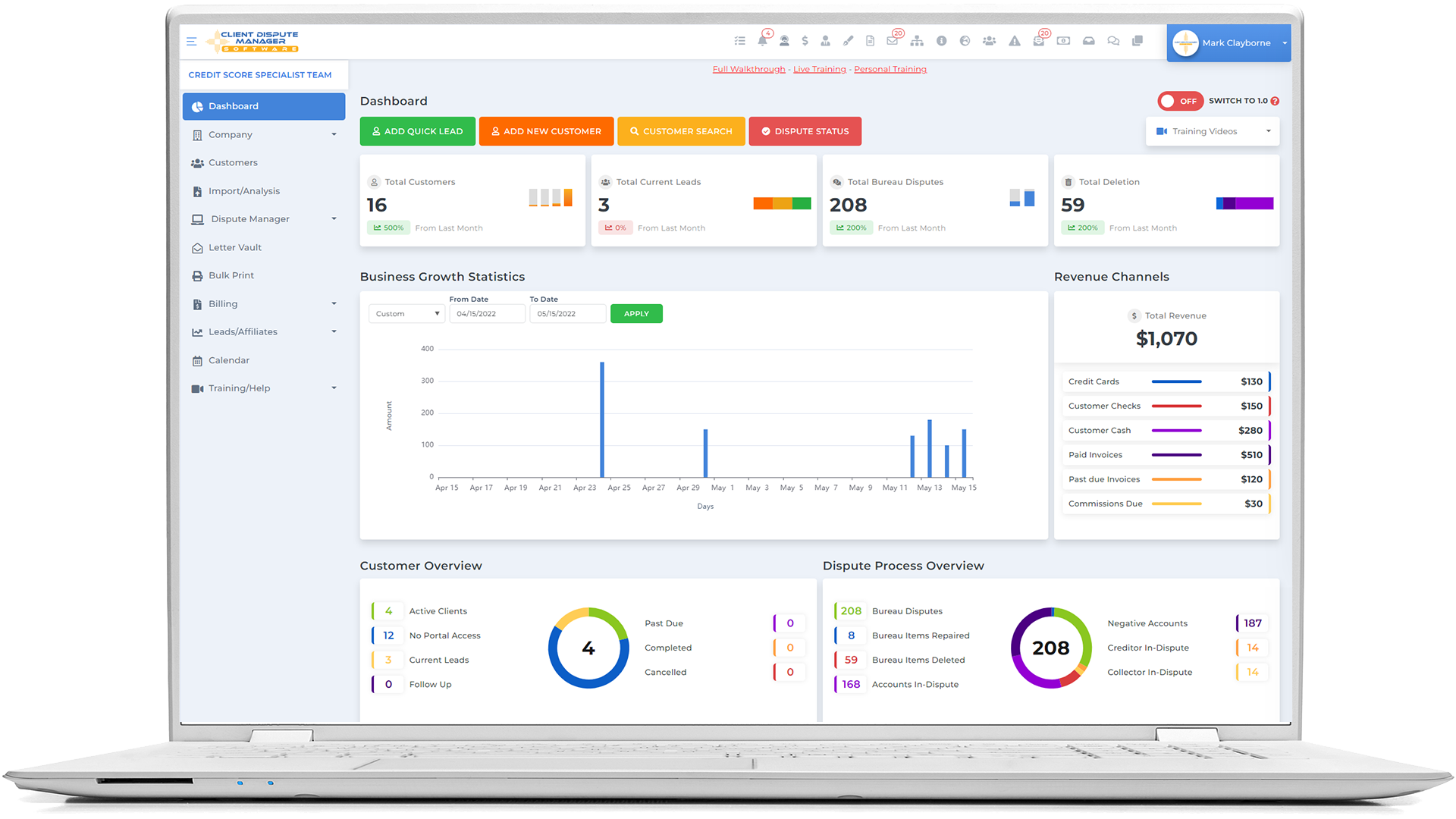

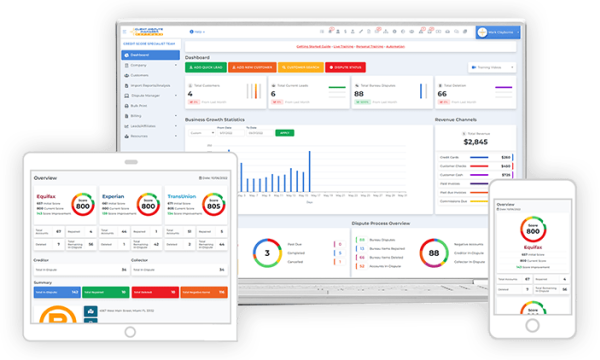

Using credit repair software can be an excellent way to help you regularly monitor your credit reports, dispute errors, and keep track of your progress, you can take control of your financial well-being and achieve a better credit score.

Introduction:

A good credit score is essential for financial stability and independence. It can impact your ability to secure a loan, get a credit card, and even rent an apartment. If you're struggling with a low credit score, you're not alone. Many people face similar challenges, but with the help of credit repair software, you can take control of your financial future.

Credit repair software is an innovative and effective tool that makes it easy to manage your credit score and financial future. If you're looking to start a credit repair business, this software provides you with the tools you need to succeed. From monitoring your credit reports to disputing errors and tracking your progress, credit repair software helps you take a proactive and strategic approach to credit repair. By using this software, you can achieve your financial goals and secure a better financial future for yourself and your family.

In this blog post, we'll be discussing tips for improving your credit score using credit repair software. So, if you're ready to take control of your credit score, read on to learn more about the benefits of credit repair software and how it can help you achieve a better financial future.

1. Regular Monitoring of Credit Reports

Regular monitoring of your credit reports is a critical step in improving your credit score. With the help of credit repair software, you can easily keep track of your credit reports and receive real-time alerts of any changes or updates. By staying vigilant and checking your credit reports regularly, you can identify and dispute any errors that may be affecting your credit score. With credit repair software, you can monitor your credit score with ease and ensure that your credit reports are accurate and up-to-date.

2. Dispute Credit Report Errors

One of the most effective ways to improve your credit score is to dispute any errors on your credit reports. Credit repair software makes this process a breeze by automating the process of generating dispute letters and tracking the progress of your disputes. The software will help you identify errors on your credit reports, and you can simply input these errors into the software to generate a dispute letter. With credit repair software, you can efficiently and effectively dispute errors on your credit reports and can have financial stability.

3. Tracking Progress

One of the key benefits of using credit repair software is the ability to track your progress in real-time. The software provides you with detailed reports on your credit score and credit reports, so you can easily see how your efforts are paying off. You can also set up alerts to notify you of any changes to your credit score, so you can stay informed and make informed decisions about how to maintain your credit score. With credit repair software, you can stay on top of your credit score and track your progress toward a better financial future.

4. Starting a Credit Repair Business

If you're looking to start a credit repair business, credit repair software is an excellent resource. The software can help you automate many of the tedious and time-consuming tasks associated with starting a credit repair business, such as client onboarding and report analysis. You can also use the software to create custom contract templates and generate credit analysis reports in just a few minutes. With credit repair software, you can start a successful credit repair business and help others improve their financial standings.

5. Professional Help

If you're seeking help from experienced professionals. Credit repair software often includes access to a network of experienced credit repair professionals who can provide you with personalized support and guidance. These professionals can help you navigate the credit repair process and achieve your financial goals. With the help of credit repair software and experienced professionals, you can take control of your financial well-being and achieve a better credit score.

Conclusion:

In conclusion, using credit repair software can be an excellent way to help you regularly monitor your credit reports, dispute errors, and keep track of your progress, you can take control of your financial well-being and achieve a better credit score. Additionally, credit repair software can also help you start a credit repair business, automate tedious tasks, and get help from experienced professionals. So, why wait? Start your free 30-day software trial today and take control of your financial future.

Start your free 30-Day Software Trial. No credit card is required and no commitments at https://www.clientdisputemanager.com/register. Sign up for the Client Dispute Manager software (free for 30 days). The software has everything you need to start as an entrepreneur or grow.

Automate the Client Sign Up and onboarding.

Process your first client within 15 minutes.

Import your client’s credit report with a single click.

Use our contract templates or create your own.

Generate credit analysis reports in less than 5 minutes.

Don't miss this opportunity to achieve your financial goals. Start your free trial today and experience the benefits of using credit repair software for yourself. If you're looking to start a successful credit repair business, this software has everything you need to succeed. So, take the first step towards a better financial future and sign up for your free trial now.

| Contact Email | [email protected] |

| Issued By | Client Dispute Manager Software |

| Website | Credit Repair Software |

| Phone | (888) 959-1462 |

| Business Address | 2598 E Sunrise Blvd, Suite 2104, Fort Lauderdale 33304, Florida |

| Country | United States |

| Categories | Business , Finance , Software |

| Tags | credit repair software , credit repair business , start acredit repair business , startup credit repair business , starting a credit repair business , client dispute manager , improve your credit score |

| Last Updated | March 25, 2023 |