Step-by-Step Guide on Using Credit Repair Business Software to Streamline Your Operations | Client Dispute Manager

Posted January 16, 2023 by SpotCodes

Do you want Step-by-Step Guide on Using Credit Repair Business Software to Streamline Your Operations? Just visit our article post and get deep information on Credit Repair Business Software.

As a credit repair business owner, you know that streamlining your operations is key to running a successful and growing business. One way to do this is by using credit repair business software. With a wide range of options available, it can be challenging to determine the best choice for you.

That's why we've put together this step-by-step guide on using credit repair business software to streamline your operations. By the end of this article, you'll have a clear understanding of how professional credit repair software can help you grow your business and serve your clients more efficiently.

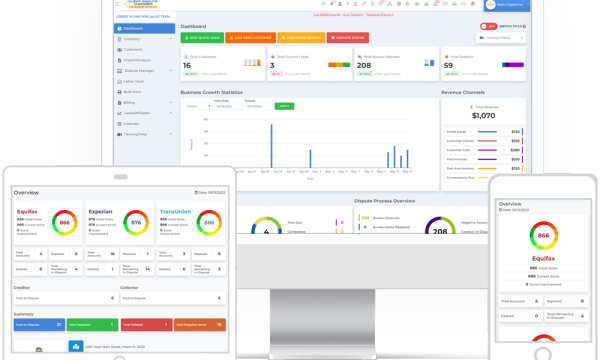

First things first, let's define credit repair software. This type of software is designed specifically for credit repair businesses and helps with tasks such as tracking client progress, automating dispute letters, and managing client accounts. It can also help you stay organized and compliant with relevant laws and regulations.

So, how do you go about choosing the right software for credit repair for your business? Here are a few key points to consider:

1. Determine your needs: The first and most important step in choosing the right credit repair software for your business is to assess your specific needs. What features are most important to your business? Do you need a solution that's primarily geared towards automating dispute letters, or do you need something that can handle a wide range of tasks such as tracking client progress, managing client accounts, and generating reports? Make a list of the features that are most important to your business and use it as a guide when comparing software options.

2. Research your options: Once you have a clear understanding of your needs, it's time to start researching your options. There are many credit repair software providers out there, so take the time to read reviews, compare features, and get a feel for the company's customer service. A reputable provider will be transparent about their pricing and offer a free trial or demo so you can see if the software is a good fit for your business. It's also a good idea to talk to other credit repair business owners and see what software they use and recommend.

3. Consider your budget: As with any business investment, it's important to consider your budget when choosing credit repair software. While it's tempting to go with the cheapest option, keep in mind that you often get what you pay for. That said, there are plenty of affordable options out there that offer a wide range of features. The key is to find a balance between cost and value. Determine how much you're willing to spend on credit repair software and use it as a guide when comparing options. Don't forget to factor in any potential cost savings you may realize by using the software to automate tasks and streamline your operations.

Now that you have a better understanding of how to choose the right credit repair software, let's talk about how it can help streamline your operations.

How Having Credit Repair Software Can Help Your Business

One of the biggest benefits of using credit repair software is the ability to automate repetitive tasks. This not only saves you time and energy, but it also helps to ensure that tasks are completed accurately and consistently. For example, you can use the software to automate dispute letters, which can be a time-consuming process if done manually. Automating this task allows you to focus on other areas of your business, such as acquiring new clients and providing excellent customer service.

Another benefit of credit repair software is the ability to track client progress in real-time. This is especially important if you have a large number of clients, as it can be difficult to keep track of everyone's progress manually. With the right software, you can easily see which clients have completed certain tasks, what their credit scores are, and what disputes are currently being worked on. This not only helps you stay organized, but it also allows you to provide better customer service by being able to quickly and easily answer any questions or concerns your clients may have.

Finally, credit repair software can help you stay compliant with relevant laws and regulations. The credit repair industry is heavily regulated, and it's important to make sure you're following all the rules and requirements. Credit repair software can help you keep track of deadlines and ensure that you're meeting all the necessary requirements.

Can Credit Repair Software Really Benefit You?

In conclusion, using credit repair business software can be a game-changer for your business. It can help you automate repetitive tasks, track client progress, and stay compliant with relevant laws and regulations. By streamlining your operations, you'll be able to serve your clients more efficiently and grow your business.

Many credit repair business owners have already experienced the benefits of using credit repair software. It has allowed them to serve more clients without hiring additional staff, and has freed up time and resources to focus on other areas of the business. If you're ready to take your credit repair business to the next level, consider investing in professional credit repair software. It's an investment that will pay off in the long run, helping you streamline your operations and serve your clients more effectively.

And if you're just starting out and wondering how to start a credit repair business, using credit repair software can be a great place to start. It can help you get your business off the ground and set you up for long-term success. So, don't wait any longer. Take control of your business and start streamlining your operations with credit repair software today.

Are you interested in trying out our software for yourself, but not sure if it's the right fit? No problem! We offer a free 30-day trial that allows you to fully test out our service before making any commitments. And the best part? You don't even need to provide a credit card to get started. Simply visit Client Dispute Manager and sign up for your free trial today. Explore all of the features and benefits of our software at your leisure and decide if it's the right fit for you and your business needs. Don't hesitate, start your free trial now!

Be your own boss, and work from your home. Get Your Free step-by-step training today. Click here to get everything you need for FREE.

| Contact Email | [email protected] |

| Issued By | Client Dispute Manager |

| Website | Credit Repair Business Software |

| Phone | 888-959-1462 |

| Business Address | 2598 E Sunrise Blvd, Suite 2104, Fort Lauderdale 33304, Florida |

| Country | United States |

| Categories | Business , Finance , Software |

| Tags | credit repair business , credit repair software , client dispute manager , credit repair business software , credit dispute manager software , credit repair software for business , how to start a credit repair business , self credit repair dispute software |

| Last Updated | January 16, 2023 |