If your Accountant doesn’t tell you this about Mileage, you can lose half of your yearly Income

Posted March 9, 2021 by Eszter_Hadnagy

Did you know that you have to record both your Business and Personal trips? You have to be able to prove your trips with a mileage log.

According to Publication 463 of the IRS which describes what your Mileage log should consist of:

"If you use your car for both business and personal purposes, you must divide your expenses between business and personal use. You can divide your expense based on the miles driven for each purpose."

Did you know that if you want to claim your Business Mileage on your taxes you have to be able to prove your trips with the help of a Mileage log?

Most Accountants, Bookkeepers, and Tax advisors say that it is enough to record your Business trips and related Odometer readings. Worse, they might advise you to take the deduction without any supporting documentation such as Mileage logs. The reason behind this misconception is mostly the name of the deduction: Business Mileage Deduction, it does not mean that you don't have to prove your Personal miles as well.

Your Mileage log has to consist of:

- The total Mileage you drove in the Tax Year for Business, Commuting, and Personal Driving;- The First Odometer or the Last Odometer reading of the year;

- The Dates of your Business and Personal trips;

- The Addresses of the Business and Personal Partners/Locations you’ve visited;

- The Ratio of your Business and Personal trips;

- And the Purpose of your Trips, for example, Office meeting, Personal shopping, etc.

If you do not have proof of your Personal trips you will not be able to prove the Ratio of your Business and Personal trips.

When Accountants ask for their client's Business Mileage to be able to add it to their tax forms, most taxpayers just give an estimated number calculating approximately how many Business miles they might have done. Then, when the IRS asks for additional supporting documentation, the taxpayers don't know how to reconstruct their Mileage logs to prove that estimated amount, since it was not based on real-life driving habits and/or actual driven miles.

Not having correct documentation will surely lead to a Fine.During an Audit, the IRS can ask you to prove your miles with supporting documentation. You can't deduct what you can't prove. If you can't prove the deduction, your Business will be subject to fines and penalties for underpayment of taxes.

Don't let others mislead youDon't leave money on the table. Losing a deduction opportunity especially during this pandemic and on top of it paying penalties for failing to meet the requirements of the IRS can be extremely damaging.

The best solution is for you to know what needs to be included in your Mileage log or to find a qualified Accountant / Tax advisor who can correctly inform you about every Tax deduction possibility and every Tax matter at hand. In the current economic situation, every penny counts, and an average taxpayer can save as much as $12,000/year on average with Mileage logs.

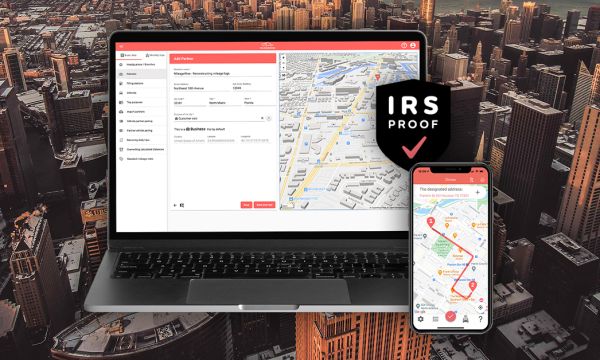

With the MileageWise Mileage Tracker App, you can easily track your Business trips, Personal trips, and Refuelings On the Go. The AdWise feature will make an IRS-proof Mileage log recommendation for you by taking into account all the legal regulations about Mileage logging and Tax return policies. Using this technology your Mileage Log will correspond to the exact Mileage you have driven according to your Odometer, even Retrospectively.

In the process the Built-In IRS Auditor examines 70 logical conflicts with a Smart Algorithm ensuring that your Mileage log will be IRS-proof, meeting Every Expectation.

If you are still worried that you can’t keep track of your mileage, Outsource It to our Experts. They will be more than happy to help!

| Contact Email | [email protected] |

| Issued By | MileageWise Inc. |

| Website | MileageWise IRS-Proof Mileage Log Web Dashboard and Mileage Tracker App |

| Phone | +1 (941) 222-1414 |

| Business Address | 677 N Washington Blvd #57 Sarasota, FL. 34236 |

| Country | United States |

| Categories | Accounting , Business , Software |

| Tags | audit , business , irs , mandatory , mileage , personal , trip , trips |

| Last Updated | March 9, 2021 |